Storm Doors Energy Tax Credit

What tax credits are available.

Storm doors energy tax credit. This is a summary of the tax credit elements related to windows and doors as set forth in section 25c of the internal revenue code as modified by the further consolidated appropriations act 2020 which was signed by the president on december 20 2019 which among other things extends the tax credits in section 25c of the internal revenue. More on saving energy. It s capped at a 200 tax credit for windows that meet the restrictions. Is there a list of energy star certified windows doors and skylights.

Does not include installation. 10 percent of the cost up to 200 for windows and skylights and up to 500 for doors. Well unlike solar panels you can t get any tax credit related to the installation costs. How to claim the energy tax credit.

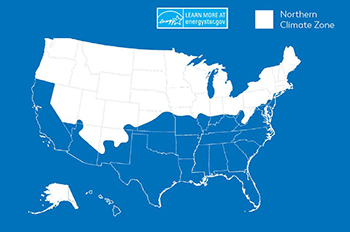

Energy star makes it easy to find the right products. The american recovery and reinvestment act of 2009 has introduced new tax credits for 30 percent of the total cost of new energy efficient storm doors with a maximum eligible amount of 1 500. Can a single window be energy star certified in all climate zones for all 50 states. Understand all of the cost savings available for using these new energy efficient tax credits before buying new storm doors.

Windows doors and skylights that are eligible for a federal tax credit must meet strict criteria. Does not include installation. Are there energy star certified storm windows and storm doors. The credit is worth 10 of the cost of the windows.